What is Ultency? Complete Guide to MetaQuotes Matching Engine

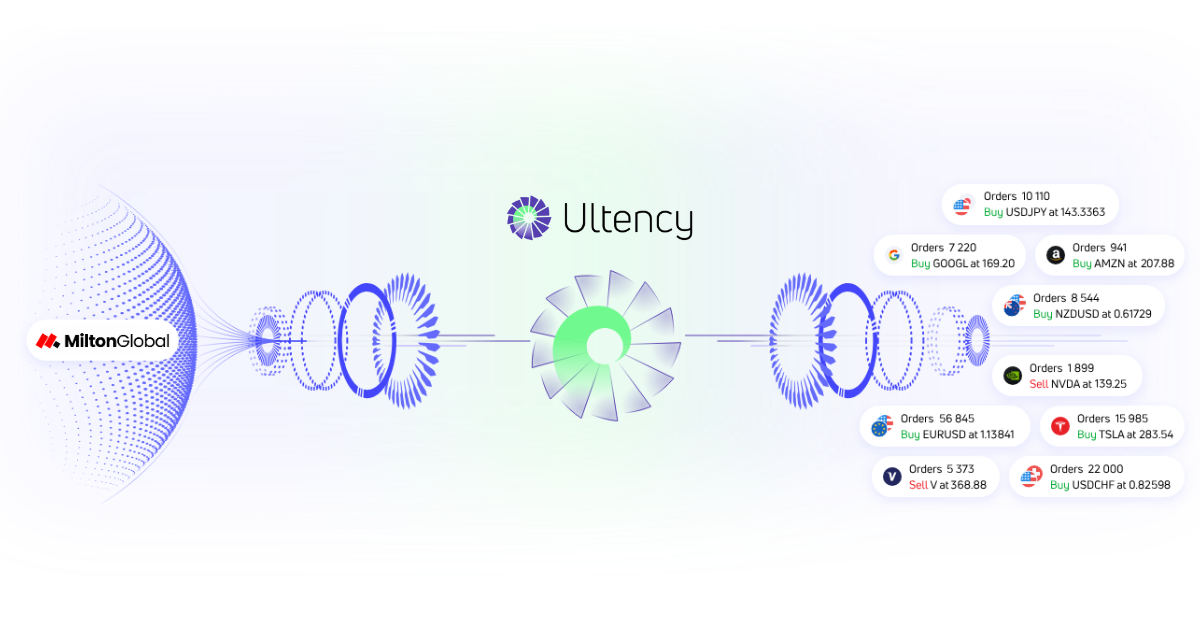

Ultency is MetaQuotes' revolutionary ultra-low latency matching engine designed specifically for MetaTrader 5 brokers. It represents a significant evolution in trading infrastructure, providing seamless liquidity aggregation, intelligent order matching, and comprehensive risk management—all within the native MT5 environment.

Quick Answers to Key Questions

What is Ultency? MetaQuotes' native MT5 matching engine that connects brokers to multiple liquidity providers with sub-10ms execution times.

Who should use Ultency? MT5 brokers seeking competitive advantages through faster execution, lower costs, and simplified liquidity management.

Why choose Ultency? It eliminates the complexity of multiple bridge solutions while delivering institutional-grade performance and comprehensive risk management.

What is Ultency and How Does It Work?

The Core Concept

Ultency is a native MT5 solution that enables reliable connections to multiple liquidity providers simultaneously. Unlike traditional bridge solutions that require external systems, Ultency is built directly into the MetaTrader 5 architecture, utilizing highly efficient internal data transfer protocols.

Key Technical Advantages:

How the Matching Engine Works

When a client places an order through MetaTrader 5, Ultency processes it through this streamlined workflow:

1. Order Reception → The order enters the Ultency matching engine

2. Price Aggregation → Ultency queries all connected LPs for current pricing

3. Best Price Selection → The system identifies the optimal available price

4. Risk Check → Configured risk management rules are applied

5. Execution → The order is routed appropriately (A-Book, B-Book, or C-Book)

6. Confirmation → Execution details are logged and confirmed to the client

This entire process occurs in milliseconds, ensuring clients experience no delays or requotes.

Who Should Use Ultency?

Target Audience

Primary Users:

Specific Use Cases

Retail Brokers benefit from Ultency's ability to offer competitive spreads while maintaining profitability through intelligent order routing. The system's B-Book capabilities allow brokers to internalize profitable flow while hedging risky positions with LPs.

Institutional Brokers offering direct market access get pure A-Book execution with multiple LP connections, ensuring deep liquidity and tight spreads for high-volume clients.

Hybrid Brokers can leverage Ultency's flexible routing to optimize profitability by configuring different execution strategies for various client groups.

Why Choose Ultency Over Traditional Solutions?

Key Benefits

1. Ultra-Low Latency Execution

2. Simplified Infrastructure Management

3. Advanced Risk Management

4. Cost Efficiency

Comparison: Traditional vs. Ultency

Traditional LP Integration Challenges:

Ultency Solutions:

What Are Ultency's Key Features?

1. Multiple Liquidity Provider Access

Ultency provides brokers with an intuitive gallery of approved liquidity providers, including institutional names like Milton Global. Brokers can connect to multiple LPs with just a few clicks, eliminating the traditional complexity of individual bridge setups and negotiations.

2. Intelligent Price Aggregation

The matching engine continuously aggregates prices from all connected liquidity providers, automatically selecting the best bid and ask prices for each instrument. This ensures clients receive optimal pricing on every trade while brokers maintain competitive spreads.

3. Zone-Based Deployment

Brokers can choose from multiple hosting locations to connect with different liquidity providers, optimizing market access and reducing latency based on geographic proximity.

4. Advanced Risk Management Tools

Ultency includes comprehensive risk management features:

How Does Milton Global Fit Into the Ultency Ecosystem?

Milton Global as an Approved Liquidity Provider

Milton Global is an approved liquidity provider on the Ultency platform, offering:

Regulatory Credibility

As an FSA-regulated broker (License SD040), Milton Global brings:

Technical Infrastructure and Architecture

Performance and Reliability Features

Dedicated Platforms: Each broker receives their own Ultency instance for maximum security and performance.

Geographic Flexibility: Choose server locations based on LP proximity to optimize latency.

Cluster Architecture: Redundant systems ensure continuous operation with minimal downtime.

Internal Protocols: Optimized data transfer between components for maximum efficiency.

Centralized Configuration: All settings managed within MT5 for simplified administration.

Getting Started with Ultency

Implementation Steps

For brokers interested in leveraging Ultency:

1. Contact MetaQuotes to set up an Ultency instance

2. Select liquidity providers from the approved gallery (including Milton Global)

3. Configure execution parameters based on business model

4. Set up risk management rules for automated position coverage

5. Begin routing orders through the optimized infrastructure

Integration Benefits

Frequently Asked Questions

Q: How does Ultency differ from traditional bridge solutions?

A: Ultency is natively integrated into MT5, eliminating the need for external bridge software while providing faster execution and simplified management.

Q: What execution models does Ultency support?

A: Ultency supports A-Book (straight-through), B-Book (internal), and C-Book (hybrid) execution models with flexible routing options.

Q: Can I connect to multiple liquidity providers through Ultency?

A: Yes, Ultency provides access to multiple approved liquidity providers, including Milton Global, through a single integration point.

Q: What are the latency benefits of using Ultency?

A: Ultency delivers consistent sub-10ms execution times through optimized internal protocols and strategic server placement.

Q: How does Milton Global's FSA regulation benefit Ultency users?

A: Milton Global's FSA license (SD040) provides regulatory credibility, client fund protection, and institutional-grade infrastructure to the Ultency ecosystem.

Conclusion

Ultency represents the future of broker infrastructure for MetaTrader 5. By combining ultra-low latency execution, multiple LP access, and sophisticated risk management in a native MT5 solution, Ultency enables brokers to compete effectively in today's demanding markets.

Key Takeaways:

Milton Global's participation as an approved Ultency liquidity provider ensures brokers have access to institutional-grade liquidity with the transparency and reliability demanded by modern trading operations.

For brokers seeking to upgrade their infrastructure and offer clients superior execution, Ultency paired with Milton Global's liquidity represents a compelling solution for sustainable competitive advantage.